|

|

State true or false with reason in support:-

Journal proper is capable of recording every type of business Transaction.

This question has 0 answers so far.

|

|

|

State true or false with reason in support:-

A ledger is a principle book of accounts

This question has 0 answers so far.

|

|

|

A firm whose books are closed on 31st March, purchased machinery for Rs.50,000 on April 2002, Additional machinery was acquired for Rs. 20,000 on October 1, 2003 and

for Rs.28,100 on 30th September 2006. On April 1, 2005 a part of the machinery

purchased for rs 20,000 on April 1, 2002 was sold for Rs.8,000. You are required to

write up the Machinery Account for 5 years. Depreciation is written off at 10% on the

written down value.

This question has 0 answers so far.

|

|

|

State the usual adjustments that have to be made while preparing the final Accounts.

This question has 0 answers so far.

|

|

|

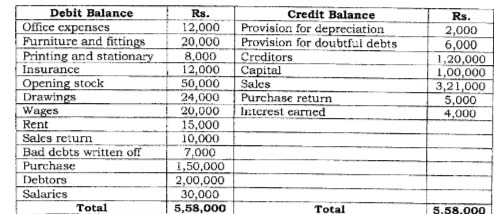

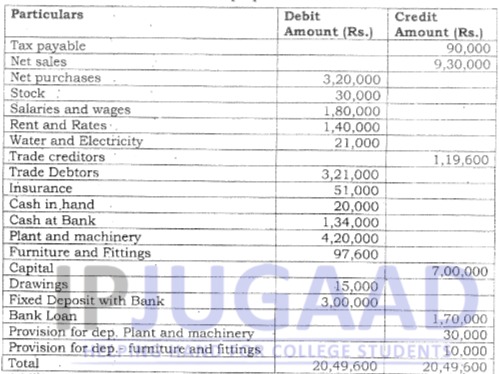

The following is the Trial Balance of Ram on 31st March, 2007

Prepare the Trading and Profit & Loss Account for the year ending

March 31, 2013 and also the Balance Sheet as on that date for making the

following adjustments

i) Depreciate furniture and fittings by 10% on original cost.

ii) Make a provision for doubtful debts equal to 5% of debtors.

iii) Salaries for the month of March amounting to rs. 3,000 were unpaid which must be

provided for. The balance in the account includes Rs.2.000 paid in advance.

iv) Insurance is prepaid to the extent of Rs.2,000

v) Provide Rs. 8,000 for office expenses.

vi) Stock valued at rs.6,000 was put up by Ram for his personal use, the cost of which

has not been adjusted in the books of account.

vii) Closing stock valued at rs.68,000 (net realizable value rs.60,000).

This question has 0 answers so far.

|

|

|

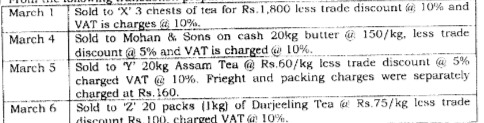

From the following transaction prepare Sales Book:-

This question has 0 answers so far.

|

|

|

Differentiate between Sales Book and Sales Account.

This question has 0 answers so far.

|

|

|

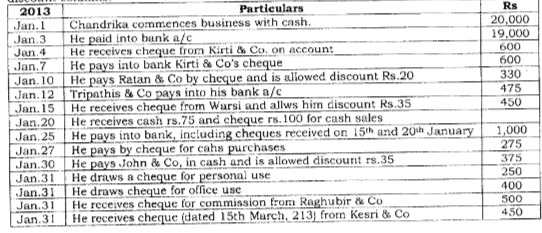

Enter the following transactions in the triple column cash book with cash, bank and discount columns.

This question has 0 answers so far.

|

|

|

What are the qualitative characteristics of Accounting Information? Explain in detail.

This question has 0 answers so far.

|

|

|

What are the Accounting Standards? Explain the meaning, nature and utility of

Accounting Standards.

This question has 0 answers so far.

|

|

|

State true or false with reason in support:- Prepaid rent appearing in the Trial Balance is taken only to the profit and loss Account.

This question has 0 answers so far.

|

|

|

State true or false with reason in support:- Diminishing method of depreciation is same as sum of digit method of depreciation.

This question has 0 answers so far.

|

|

|

State true or false with reason in support:- Accounting as a discipline is not related with other discipline like 'Law' etc.

This question has 0 answers so far.

|

|

|

State true or false with reason in support:- LIFO method is suitable for items which are of non perishable and bulky items.

This question has 0 answers so far.

|

|

|

Attempt any three parts: (a) Explain the relationship of accounting with other allied disciplines.

(b) Explain the reasons for changing depreciation as an expense. (c) Why do we create for provision for bad debts in books of amount? State

its relevance.

(d) Distinguish between LIFO & FIFO. Which method is better under the

state of rising prices and why? (e) What are Accounting Standards? Why are these issued?

This question has 0 answers so far.

|

|

|

State true or false with reason in support:- The convention of disclosure implies that all material information should be disclosed in the accounts.

This question has 0 answers so far.

|

|

|

State true or false with reason in support:- Inventory should be valued at the lower of historical cost and current replacement cost.

This question has 0 answers so far.

|

|

|

State true or false with reason in support:- Credit note is sent to a customer when goods sold on returned by him.

This question has 0 answers so far.

|

|

|

State true or false with reason in support:- The convention of conservatism takes into account all prospective profits but leaves all prospective losses.

This question has 0 answers so far.

|

|

|

State true or false with reason in support:- The basic function of financial accounting is to assist the management in performing functions effectively.

This question has 0 answers so far.

|

|

|

R. Ltd bought machinery for Rs. 30,000 on 1st April, 2001. One more machinery was purchased on 1st October, 2001 costing Rs. 20.000. On

1st July, 2002, a new machinery for Rs. 10,000 was added to the existing

machinery. On 1st January, 2003, one third of the Machinery which was

installed on 1st April, 2001 was sold for RS. 3,000/-. Show the Machinery

Ac in the books of the company. The rate of depreciation is 10% on

reducing balance method.

This question has 0 answers so far.

|

|

|

Differentiate between- (a) Outstanding Expense and Prepaid Expense (b) Outstanding Income and Accrued Income

(c) Interest on Capital and Interest on Drawings

This question has 0 answers so far.

|

|

|

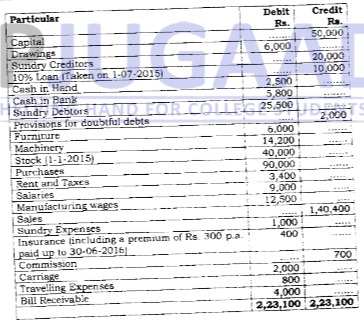

From the following trial balance of XYZ Lid., you are required to prepare Trading and Profit and Loss A/C for the year ended 31st December, 2015

and balance sheet on that date.

Adjustments:- (a) Stock on 31-12-15 was Rs. 38.000

(b) Write off Rs. 500 bad debts and maintain the provision for doubtful

debt at 5% on debtors.

(c) Manufacturing wages include Rs. 800 for erection of new machinery

on 1 Jan., 15. (d) Depreciate machinery by 5% and furniture by 10%

This question has 0 answers so far.

|

|

|

Explain the different types of Goods Journals with suitable examples.

This question has 0 answers so far.

|

|

|

b) Record the following transactions in the cash book and post them in the ledger: Jan. 1 Opening Balance Cash Rs. 3000/-

Bank Rs. 4000/-

Jan. 4 Rent paid by cheque Rs.2000/-

Jan. 6 Received on account of cash sales Rs.3000/-

Jan. 8 Paid to Mehta Bros by cheque Rs 2000/- and earned Rs. 200,-

as cash discount

Jan. 10 Received from suresh by cheque Rs. 2000/- and allowed him

Rs. 100/- as cash discount

Jan 12 Cash Sales Rs. 20000/- Jan. 20 Cash Purchases Rs. 5000/- Jar. 31 Salaries paid Rs. 5000/-

This question has 0 answers so far.

|

|

|

b) What is an opening entry?

This question has 1 answers so far.

|

|

|

During the month of January following receipts and issue of material were made. Record these transaction in store ledger on FIFO and

weighted average method. Receipts

Jan 1 Balance 50 units @ Rs.4 per unit

Jan 5 Purchase Order No. 10, 40 units @ Rs.3 per unit

Jan 8 Purchase Order No. 12, 30 units @ Rs.4 per unit

Jan 15 Purchase Order No. 11, 20 units @ Rs.5 per unit

Issues Jan 10 Material requisition no.4,70 units

Jan 12 Material requisition no.5, 10 units

Jan 20 Material requisition no.6, 20 units

Jan 24 Material requisition no.7, 10 units

Jan 27 Material requisition no.8, 5 units

Jan 26 Purchase Order No. 13, 40 units @ Rs.3 per unit

This question has 2 answers so far.

|

|

|

A limited company purchased on 1st January 1998 a second hand plant for Rs. 12,000 and immediately spent Rs.8000 on its overhauling. On 1st

July in the same year additional plant costing Rs.10,000 is purchased.

On 1st July 2000 the plant purchased on 1st Jan. 1998 having become

obsolete is sold for Rs.4000 and on the same date fresh plant is

purchased at the cost of Rs.24,000.

Depreciation is provided @ 10% per annum on original cost on 31st Dec

every year. In 2001 the company changes the method of depreciation

and adopts the diminishing balance method @15% from retrospective

affect.

Prepare machinery Account and depreciation account.

1 inuddor account.com

This question has 1 answers so far.

|

|

|

Why adjustment entries are required to be made at the time of preparing

Final Accounts. Give illustrative examples of any five such adjustment entries.

This question has 1 answers so far.

|

|

|

From the following information prepare trading and profit and loss A/C and Balance sheet as on 31 March, 2019. Adjustments:- 1. Stock on 31st March, 2019 was value at Rs.20,000

2. Depreciation on premises Rs.300 and furniture Rs.260

3. Create provision on doubtful debtors @5%

4. Interest on capital @5%

5. Unexpired insurance Rs.700

This question has 1 answers so far.

|

|

|

Enter the following transactions of M. Raur in a Double Column Canh Book

and post them to concerned accounts in the ledger:

This question has 1 answers so far.

|

|

|

On 1st January 2019, the following were the balance of Rajan & Co.: Cash

in hand Rs.900; Cash at bank Rs.21,000, Soni (Cr.) Rs.3,000; Zahir (Dr.)

Rs.2,400; Stock Rs.12,000; Prasad (Cr.) Rs.6,000; Sharma (Dr.) Rs.4,500;

Lall (Cr.) Rs.2,700. Journalise the above transactions.

This question has 1 answers so far.

|

|

|

What are the fundamental accounting assumptions? Explain their

implications.

This question has 1 answers so far.

|

|

|

Explain the following

a) Convention of conservatism

b) Matching concept

c) Need for Accounting standards

d) Branches of Accounting

e) Inter-relationship between Accounting and Management

This question has 1 answers so far.

|

|

|

. e) Compare the LIFO and FIFO methods of inventory valuation.

This question has 1 answers so far.

|

|

|

d) Explain the Imprest System of preparing Petty cash book.

This question has 1 answers so far.

|

|

|

c) Explain the need and significance of charging Depreciation.

This question has 1 answers so far.

|

|

|

Define "Inventory" Why proper valuation of inventory is important?

This question has 0 answers so far.

|

|

|

Attempt any three parts: State the persons who should be interested in accounting information.

This question has 1 answers so far.

|

|

|

What is perpetual inventory system? How is it different from periodic inventory system? Which one you consider is better and why?

This question has 0 answers so far.

|

|

|

What are the limitations of final accounts of a firm along with the importance. Explain clearly.

This question has 0 answers so far.

|

|

|

On 1st July, 2013 a company purchased a machine for Rs. 3,90,000 and spent Rs. 10,000 on its installation. It decided to provide depreciation @ 15% per

annum, using written down value method On 30th November, 2016 the

machine was dismantled at a cost of Rs. 5,000 and then sold for Rs. 1,00,000. On 1st December, 2016 the company acquired and put into operation a new

machine at a total cost of Rs. 7,60,000. Depreciation was provided on the same

basis as had been used in case of earlier machine. The company closes its

books of account every year on 31st March.

Prepare Machinery amount and depreciation account for the four accounting

years ended 31st March, 2017.

This question has 0 answers so far.

|

|

|

What is inventory? What are its different forms? What is the rationale for valuation of inventory? Which method do you think is better for evaluation

amongst numerous methods of inventory valuation?

This question has 0 answers so far.

|

|

|

From the following data prepare the Trading, Profit and Loss Account and Balance Sheet for the year ending on 31st Dec. 2017. Trial Balance of M/s Kumar Bros. for the year ending on 31st Dec. 2017

Additional Information: (a) Closing stock amounted to Rs. 70,000.

(b) Provision for depreciation is to be made for the current year:

- Plant and machinery @ 10% on Book value.

- Furniture and fittings @ 8% on book value.

(c) Outstanding expenses: Wages

Rs. 8,000

Water and Electricity Rs. 3,000

(d) Prepaid expenses: Rent and Rates: Rs. 14,000

Insurance

Rs. 25,000

(e) Accrued Income: Accrued interest upto and including 31 Dec. 2017 is Rs. 13,000.

(f) Provide for doubtful debts: 4% of total debtors.

This question has 0 answers so far.

|

|

|

Distinguish between the following: (a) Cash Book and Petty cash book (b) Journal and journal proper (c) Straight line method and written down value method of changing

depreciation. (d) Trading and profit and loss account

(e) Provision and Reserve

Capital expenditure and revenue expenditure.

This question has 0 answers so far.

|

|

|

Reward the following adjustments in the books of accounts (a) Loss of goods by fire Rs. 8,000

(b) Pilferage loss Rs. 4,000.

(c) Bad debts Rs. 5,000

(d) Outstanding expenses Rs. 3,000

(e) Remuneration of manager Rs. 20,000 not reward in books.

(f) Sales Rs. 20,000 is on approval basis.

This question has 0 answers so far.

|

|

|

Explain the following with the help of examples:- (a)Business Entity Concept

(b)Convention of Prudence

(c)Matching concept

(d)Dual Entity concept

(e)Accrual concept

This question has 0 answers so far.

|

|

|

What is accounting? What is the importance of accounting records and information for its stakeholders?

This question has 0 answers so far.

|

|

|

Pass an opening entry in the journals on the basis of the following information on 1. April 2015

Cash in hand 2000/-

Sundry Debtors 6000,-

Stock 4000/

Machinery 11000/-

Furniture 5000/-

Sundry Creditors 1000/-

This question has 1 answers so far.

|

|

|

State true or false with reason in support:-

Balance sheet is always balanced.

This question has 0 answers so far.

|

|

|

Distinguish between Simple Average Method' and 'Weighted Average Method' of inventory valuation.

This question has 0 answers so far.

|

|

|

Distinguish between LIFO and FIFO method of inventory valuation.

This question has 0 answers so far.

|

|

|

"Accrual concept is often described as matching concept".

This question has 0 answers so far.

|

|

|

Accounting equation is based on dual concept. Do you agree?

This question has 0 answers so far.

|

|

|

Distinguish between bookkecping and accounting.

This question has 0 answers so far.

|

|

|

State true or false with reason in support:-

Machinery account can have ret credit balance.

This question has 0 answers so far.

|

|

|

State true or false with reason in support:-

Cash Account and Cash Book is one and the same.

This question has 0 answers so far.

|

|

|

State true or false with reason in support:-

Lower of cost or market value should be used in valuation of fixed assets.

This question has 0 answers so far.

|

|

|

State true or false with reason in support:-

Accounting as a discipline is not related with other discipline like"Law' etc.

This question has 0 answers so far.

|

|

|

State true or false with reason in support:-

"Separate Business Entity" refers to separation of various businesses.

This question has 0 answers so far.

|

|

|

State true or false with reason in support:-

Profit and Loss account shows the financial position of the concern.

This question has 0 answers so far.

|

|

|

Explain perpetual inventory control system.

This question has 0 answers so far.

|

|

|

State true or false with reason in support:-

Some of the Accounting standards in India are mandatory.

This question has 0 answers so far.

|

|

|

State true or false with reason in support:-

'Closing stock and closing inventory is one and the same.

This question has 0 answers so far.

|

|

|

State, giving reasons in brief, whether the following statement is 'true' or 'false'.

Profit and loss Account shows the financial position of the concern.

This question has 0 answers so far.

|

|

|

State, giving reasons in brief, whether the following statement is 'true' or 'false'.

The trial balance is prepared primarily to check the arithmetical accuracy of the double entry

Profit and loss Account shows the financial pri

This question has 0 answers so far.

|

|

|

State, giving reasons in brief, whether the following statement is 'true' or 'false'.

A contra entry is made in the cash book when the owner introduces additional capital.

This question has 0 answers so far.

|

|

|

State, giving reasons in brief, whether the following statement is 'true' or 'false'.

Posting means transfer of the accounts in the journal proper to the ledger

This question has 0 answers so far.

|

|

|

State, giving reasons in brief, whether the following statement is 'true' or 'false'.

Outstanding rent account is a personal account.

This question has 0 answers so far.

|

|

|

State, giving reasons in brief, whether the following statement is 'true' or 'false'.

In india, accounting standards are issued by Securities and Exchanges Board of India(SFBI).

This question has 0 answers so far.

|

|

|

LUNI, LIVITC ras t 'Anticipate no profits but provide for all los

State, giving reasons in brief, whether the following statement is 'true' or 'false'.

Lower of cost or market value rule should be used only in the valuation of feed assets.

This question has 0 answers so far.

|

|

|

State, giving reasons in brief, whether the following statement is 'true' or 'false'.

The materiality convention emphasise that: "Anticipate no profits but provide for all losses".

This question has 0 answers so far.

|

|

|

State, giving reasons in brief, whether the following statement is 'true' or 'false'.

Accounting and book-keeping are two terms that have the same meaning

This question has 0 answers so far.

|

|

|

Fill in the blanks

Accounting process starts with________and ends with______.

This question has 0 answers so far.

|

|

|

State, giving reasons in brief, whether the following statement is 'true' or 'false'.

The adoption of FIFO method results in a profit inflation during period of rising prices.

This question has 0 answers so far.

|

|

|

Define Accounting State its functions. How does it differ from Book Keeping?

This question has 0 answers so far.

|

|

|

Discuss briefly the basic accounting concept and accounting assumptions

This question has 0 answers so far.

|

|

|

State true or false with reason in support (a) Accounting records only transactions which are of a financial

character.

(b) It is on the basis of going concern concept that the assets are always

values at market price

(c) In accounting all business transactions are recorded as having a dual

aspect

(d) The terms loss and Expense have synonymous meaning (e) While posting transactions in the ledger, if the account is dcbited in

Journal, it will be credited in the ledger

(f) Purchase Journal is meant for recording all purchases of goods.

(g) All intangible Assets are fictitious assets. (h) Goods taken out by the proprietor from the business for his personal

use are credited to Sales Account (i) Depreciation is charged on the book value of the asset each year in

case of Diminishing Balance Method

(j) Periodic inventory gives a continuous balance of stock in hand

This question has 0 answers so far.

|

|

|

What is depreciation? What is the need of providing depreciation? State the various caused of depreciations. Explain straight line and written down value

methods with suitable examples.

This question has 0 answers so far.

|

|

|

Explain the various components of the term "Final accounts". lllustrate the financial treatment of any 10 adjustment entries with example,

This question has 0 answers so far.

|

|

|

What is purchase books? Illustrate with example,

This question has 0 answers so far.

|

|

|

Why is it necessary to sub-divide a journal? Explain various special/ subsidiary books.

This question has 0 answers so far.

|

|

|

Differentiate between real, nominal and personal account.

This question has 0 answers so far.

|

|

|

Explain various accounting concepts and conventions in brief.

This question has 0 answers so far.

|

|

|

What is financial accounting and how does it differ from management accounting? What are the limitations and advantages of financial accounting?

List the users of financial accounting information.

This question has 0 answers so far.

|

|

|

b) Record the following transactions in the cash book and post them in the ledger: Jan. 1 Opening Balance Cash Rs. 3000/-

Bank Rs. 4000/-

Jan. 4 Rent paid by cheque Rs.2000/-

Jan. 6 Received on account of cash sales Rs.3000/-

Jan. 8 Paid to Mehta Bros by cheque Rs 2000/- and earned Rs. 200,-

as cash discount

Jan. 10 Received from suresh by cheque Rs. 2000/- and allowed him

Rs. 100/- as cash discount

Jan 12 Cash Sales Rs. 20000/- Jan. 20 Cash Purchases Rs. 5000/- Jar. 31 Salaries paid Rs. 5000/-

This question has 0 answers so far.

|

|

|

Fill in the blanks :

_____discount is allowed to promote sales and_____discount is allowed to encourage prompt payment.

This question has 0 answers so far.

|

|

|

Fill in the blanks:-

According to _______ principle, revenues are matched with_________during an

accounting period.

This question has 0 answers so far.

|

|

|

State true or False with reason "Closing stock if appears only in trial balance, is taken only to balance sheet".

This question has 0 answers so far.

|

|

|

State true or False with reason FIFO inventory valuation method is most suitable in times of falling price.

This question has 0 answers so far.

|

|

|

State true or False with reason Financial accounting ignores important non-monetary information.

This question has 0 answers so far.

|

|

|

State true or False with reason that On the basis of going concern concept, assets are always valued at market value.

This question has 0 answers so far.

|

|

|

State true or False with reason "Sales journal is used for recording both cash sales and sales on credit".

This question has 0 answers so far.

|

|

|

State true or False with reason "Goods are ordered for delivery next month "represents a business activity.

This question has 0 answers so far.

|

|

|

XYZ Electronics Company had the following transaction during April while conducting its television and mobile phone repair business.

(al A new repair truck was purchased for Rs. 1.90,000.

(b) Parts with a cost of Rs. 16000 were received and used during April

(c) Service revenue for the month was Rs. 3.34.000 but only Rs. 205000

was cash sales. Typically, only 95% of credit sales are realized.

(d) Interest expenses on loans outstanding was Rs. 8800.

(e) Wages costs for the month totaled Rs. 100000. However Rs. 14000 of

this had not yet been paid to the employees.

(f) Parts inventory from the beginning of the month was depleted by Rs.

21000.

(g) Utility bills totaling Rs. 15000 were paid Rs. 7000 of this amount was

associated with March's operations.

(h) Depreciation expenses was Rs. 27000.

(i)Selling cxpcnscs were Rs. 19000.

(j) A provision for income taxes was established at Rs. 28000.

(k) Administrative and miscellaneous expenses were recorded at Rs.

47000.

Required-Prepare a detailed income statement.

This question has 0 answers so far.

|

|

|

A company uses the periodic inventory method. In its most recent fiscalyear 2011-12, the company had: beginning inventory Rs. 50,000, gross purchases of Rs. 1,67,000, freight in of Rs. 4000 and purchascs returned to supplier totaling Rs. 8000 and ending inventory of Rs. 77,500. Make the year-end adjusting and closing entries to reflect the above information in the inventory, cost of goods sold and income summary accounts. Theri assuming sales of Rs. 3,25,000, other expenses

(excluding taxes) of Rs. 95000 and a tax rate of 30%, prepare an income

statement for the year, reflecting the computation of the cost of goods

sold amount.

This question has 0 answers so far.

|

|

|

On March 31, the Mohan's shop had no water bottles on hand. During the next four months it first purchased 50 water bottles for Rs. 14 each and then 75 more for Rs. 12 each. During these four months, 100 water bottics were sold. Required:

What will be the July 31 water bottle inventory amount and the four

months cost of goods be if the Mohan's shop uses the periodic inventory

method: (a) Average cost (B) FIFO (C)LIFO

This question has 0 answers so far.

|